Professional Insight

Focus on the Value of your Accounting Practice

Topics discussed in this paper include:

Accounting Firms Industry Method Income Types

More than any other industry segment, Professional Services firms are now themselves the subject of a significant number of Business Valuation Reports issued. And the reason is simple. Business Owners rely on their Accountant to provide expert, objective and impartial advice to help grow their business. And this is because it’s hard to see-the-wood-for-the-trees when it comes to escaping the day-to-day of running a business. But when an Accountant can’t see the wood for the trees in relation to their own practice, who should they turn to?

Why value your firm?

There are over 30,000 small to medium sized Accounting businesses in Australia (defined as revenue under $10mil per annum).

In any industry with such a large number of participants, the business model is often very similar. Accounting and Tax Agent firms are no different.

And, where there are a large number of participants, there are also a large number of transactional activities:

- Buying or Selling complete firms

- Partner buy-ins

- Restructures

- Setting key-person insurance levels

- Exit agreements

- …the list could go on…

One fundamental underpins many of these transactions – what is the agreed value of the firm?

How the value of your Practice is established

Given the size of the industry segment (i.e. the large number of participants) and the broadly similar nature of the business model across the segment, the Industry Method is often the most appropriate model to determine the value of a firm.

Using the Industry Method, the valuation of Accounting Practices is commonly expressed as a multiple of gross ongoing fees received. The multiple can range from 0.50 to 1.10 times yearly gross fee income.

The first step in determining the appropriate valuation multiple is to conduct a detailed review of its different income types.

That is then considered in the context of other, often external, factors often including:

- Profit of the business

- Whether the fee book or entire firm is being valued

- Size of the business / fee book

- Age of business

- Growth of the business

- Has growth been organic or acquired

- Competition in the area

- Demographics of area

- Demographics of clients

- Reliance of key person

- Reliance on major client(s)

Growing the value of your Practice

A careful review of all elements of the business, both internal and external, will often identify areas of opportunity.

In this respect, Accounting Practices are no different to any of the small businesses run by their clients.

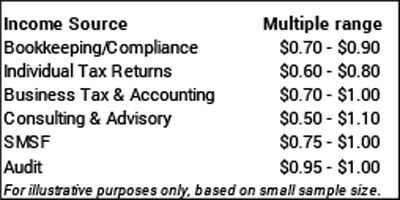

The following table serves to illustrate the range of multiples as applied to typical income streams of a selection of Accountancy Practices recently valued.

A consideration of the multiples applied to each income stream helps highlight areas of opportunity.

Fees generated from work such as Individual Tax Returns & Bookkeeping are placed at the lower end of the range.

These types activities are becoming easier for clients to undertake themselves and therefore are putting downward pressure on the prices Accountants to can charge for this type of work. Add to this, Governments are making it increasingly easier for individual clients to lodge their own tax return. Further, small business clients are finding they can do their own bookkeeping work due to the vast improvements in cloud-based accounting software tools such as XERO and MYOB.

More specialised accounting work such as Self Managed Superannuation Fund (SMSF) administration, Corporate Advisory, Business Accounting and Audit are valued higher on the range of multiples.

It is extremely hard, and could certainly be misleading, to list average multiples for each fee type without first reviewing the particular Accounting business in question. There are considerations unique to each and every valuation that influence just what multiple is eventually applied. However the careful review of a business in its entirety can yield valuable results.

An independent business valuation compiled by a professional can help.

Contact BIZVAL to learn more and order your expert business valuation today.