Case Study

Valuation Methodology and

Business Valuations

Topics discussed in this paper include:

Valuation Methodology Methodology Testing Applying Methods

Accountants and Business Owners are frequently curious to understand the science behind a professionally executed valuation. Determining the most appropriate valuation method is the first step. This paper outlines the process a Valuer undertakes to help determine the most appropriate and valid valuation method to apply in each situation.

Backgrounder…

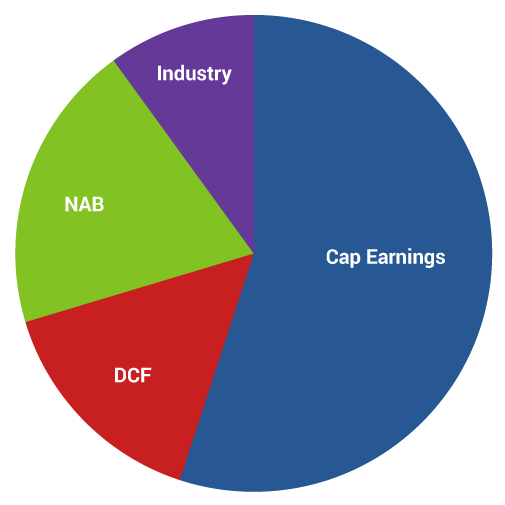

Most valuations undertaken will fall into one of four commonly accepted valuation methods: Capitalisation of Earnings, Discounted Cash Flow, Net Asset Backing or an Industry-Specific method.

The Capitalisation of Earnings and Discounted Cash Flow methods are based on an Earnings Approach, the Net Asset Backing method is an ‘Asset Approach’ and Industry-Specific methods fall under a ‘Market Approach’. The graph illustrates the frequency each method might be applied in a given period.

Capitalisation of Earnings

Is used to value established businesses and businesses whose earnings are expected to remain relatively stable. The focus of this methodology is on identifying the sustainable earnings and the associated risk of a business. The value is calculated by applying the risk rate to the identified maintainable earnings.

Discounted Cash Flow Method

Is used to value businesses whose cash flows are likely to vary over upcoming years, businesses with a limited trading history, and/or where the rate of earnings growth is expected to vary considerably from year to year.

Industry Method

Is used to value businesses of an industry type that have a large number of participants in the industry and frequent transactions of buying and selling these businesses. It assumes a common valuation method amongst certain business types.

Net Asset Backing Method

Is used to value businesses with substantial tangible assets and/or businesses where the break-up value of assets is likely to exceed the going concern value. The value is calculated by using the net tangible assets of the business.

Situation Analysis

So, how do we decide which method to use? In determining the most appropriate method, we review the business for the following factors:

Is Revenue ongoing?

- Yes – Consider Capitalisation of Earnings

- No – Use the Net Asset Backing method or Discounted Cash Flow method.

Diversified Customer Base?

- Yes – Consider Capitalisation of Earnings or Discounted Cash Flow methods

- No – Consider Net Asset Backing

Industry Method available?

- Yes – Use Industry Method as either primary or secondary method

- No – Disregard Industry Method

Stable Earnings?

- Yes – Consider Capitalisation of Earnings

- No – Consider Discounted Cash Flow

Is the business Profitable?

- Yes – Use Capitalisation of Earnings or Discounted Cash Flow

- No – Use Net Asset Backing

Outcome

Essentially, there are many factors that need to be considered before adopting a business valuation method. Every business and industry is different and we treat every business valuation on a case-by-case basis. Quite often we will test a business under two methods before arriving at the primary valuation method.

An independent business valuation compiled by a professional can help.

Contact BIZVAL to learn more and order your expert business valuation today.