Fact Sheet

Enterprise, Equity, Goodwill and

Business Valuations Explained

Topics discussed in this paper include:

Enterprise Valuation Equity Valuation Goodwill

A key consideration of every business valuation is determining exactly what requires valuing. Is it the business enterprise, shares in the holding company, goodwill or all of the above? This paper seeks to clarify the differences between an Enterprise Valuation and an Equity Valuation and outline how Goodwill is calculated.

Backgrounder…

A key consideration in every business valuation is to determine exactly what is being valued. There are generally two ‘levels’ a business valuation can assess: Enterprise Value or Equity Value. A Valuer, in conjunction with their client, needs to determine which is the most appropriate for each valuation engagement.

Goodwill is a regularly discussed topic within business valuations. In looking at Enterprise and Equity Valuations, we will also illustrate how Goodwill is calculated.

Enterprise Value or Equity Value…

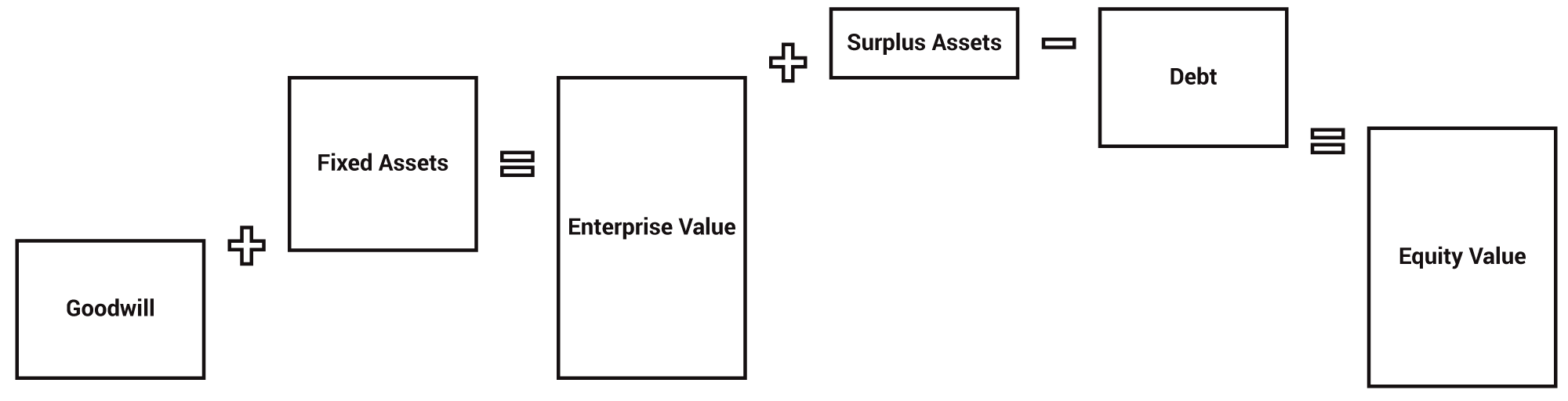

The Enterprise Value is the value of the business including Goodwill, Intellectual Property and all Plant & Equipment needed to operated the business.

The Equity Value seeks to value the entity that the business is operating through (eg company, unit trust) and is derived by taking the Enterprise Value and adding any surplus assets (eg cash) and deducting liabilities.

To illustrate using an example:

John and Ron Cherry operated a fresh fruit & vegetable retail outlet called ‘Cherry Brothers’. They owned the business through a private company ‘Cherry Enterprises Pty Ltd’. The company also owned a cherry farm in regional Victoria, held $500k in term deposits and owned two luxury motor vehicles. By way of liabilities, the company had a mortgage of approximately $200k over the farm.

John and Ron decided they no longer wanted to operate the ‘Cherry Brothers’ retail outlet and decided to put it on the market. To assist in assessing the retail outlet’s value John and Ron engaged a professional Valuer to undertake a business valuation.

In this scenario, the Enterprise Value needs to be determined as they are only selling the retail outlet, not the company or any other assets of the company.

Conversely, if the Equity Value was being determined it would include the retail outlet, the farm, the term deposits, the motor vehicles and the mortgage. The Equity Value would be used in a situation such as a transfer of shares in ‘Cherry Enterprises Pty Ltd’.

Most valuation methods calculate the Enterprise Value. A Valuer then needs to make adjustments to the Enterprise Value to determine the Equity Value.

Goodwill is often discussed and can be source of contention amongst Accountants, Valuers and Clients. Once the Enterprise value is determined, it is relatively easy to calculate the goodwill value. Goodwill is simply the Enterprise Value minus tangible assets, usually Plant & Equipment.

The following graph illustrates the relationship between the factors discussed above:

In closing…

The purpose of a business valuation will usually determine whether an Enterprise Valuation or Equity Valuation is required. Having a clear understanding of the purpose assists the Valuer to make the correct recommendation of which level of valuation is needed.

Goodwill is calculated after a business enterprise has been valued. It is the residual amount after taking the Enterprise Value and deducting tangible assets. In other words it is the ‘intangible’ component of a business valuation which can only be determined after the entire business enterprise has been valued.

An independent business valuation compiled by a professional can help.

Contact BIZVAL to learn more and order your expert business valuation today.